Lime Petroleum in Norway

Transition to full cycle exploration and production

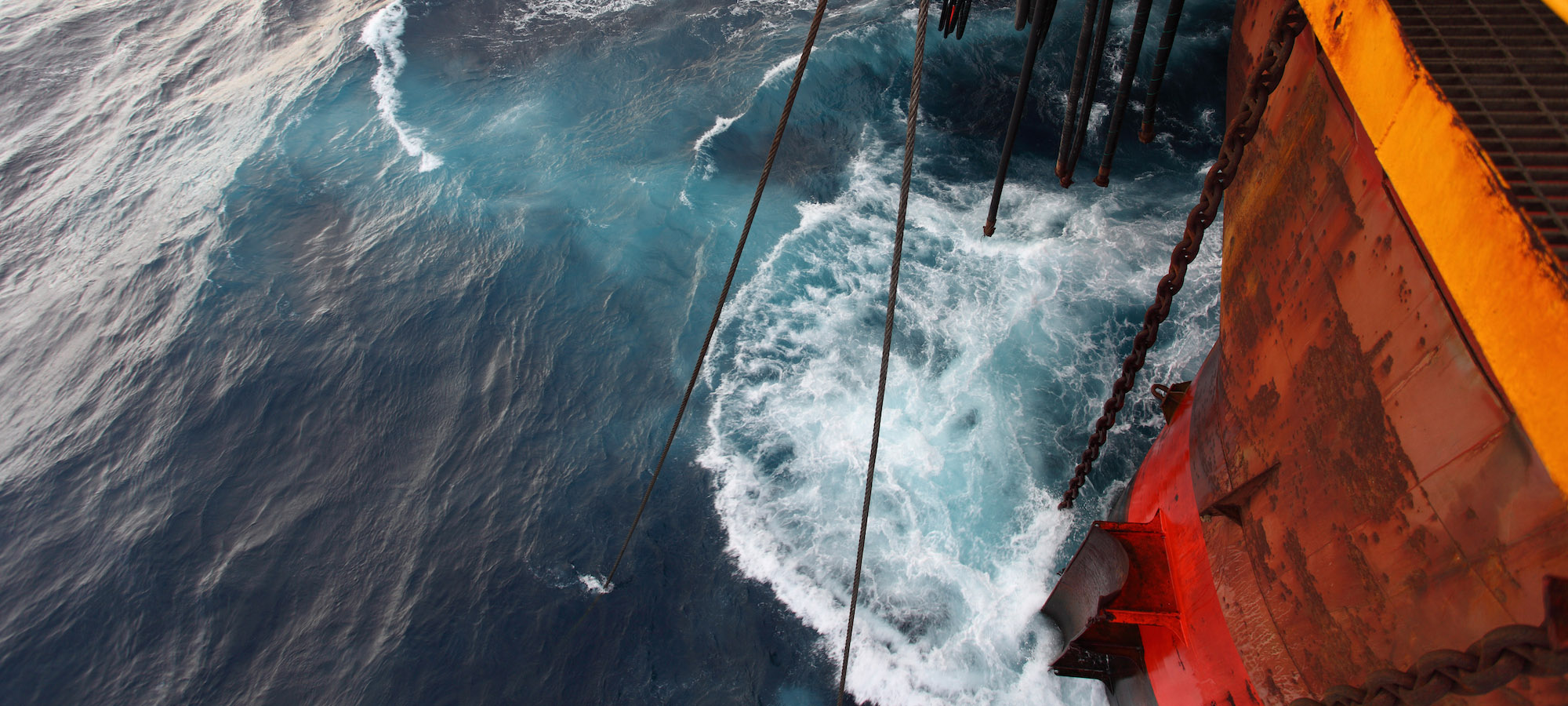

The Rex International Holding Group has been holding interests in licences in Norway since 2013. In 2021, subsidiary Lime Petroleum AS's most significant transaction was its acquisition of a 33.8434% interest in the producing Brage Field, marking its transition from pure-play exploration to a full cycle exploration and production company on the Norwegian Continental Shelf, and to establish recurring cash flow, as well as develop and drive further value in the company's existing portfolio.

Lime Petroleum AS currently has interests in 17 licences in the Norwegian Continental Shelf, including 33.8434% in the producing Brage Field and 25% in the producing Yme Field.

Lime petroleum AS

Rex’s subsidiary Lime Petroleum AS ("LPA"), was established in 2012 with offices in Oslo, Norway. LPA has since built a portfolio of licences focusing on mature areas close to existing oil and gas infrastructure. LPA was pre-qualified in February 2013 as a partner company and in March 2023, as an operator on the Norwegian Continental Shelf.

The organisation has vast expertise in oil & gas exploration and production, both from Norway and internationally.

LPA uses high-quality seismic data and the Group's Rex Virtual Drilling technology, together with conventional seismic attributes and analysis of the petroleum systems in its exploration efforts.